BTC Price Prediction: Analyzing the Path to $200K Amid Current Volatility

#BTC

- Technical Support: BTC is testing critical support at $109K, with Bollinger Bands hinting at a potential rebound if the level holds.

- Market Sentiment: News highlights volatility from options expiry and security events, though institutional adoption continues to grow.

- Cyclical Outlook: Historical patterns similar to 2017 suggest a long-term path toward $200K, but short-term caution is warranted.

BTC Price Prediction

BTC Technical Analysis: Critical Support Test at $109K

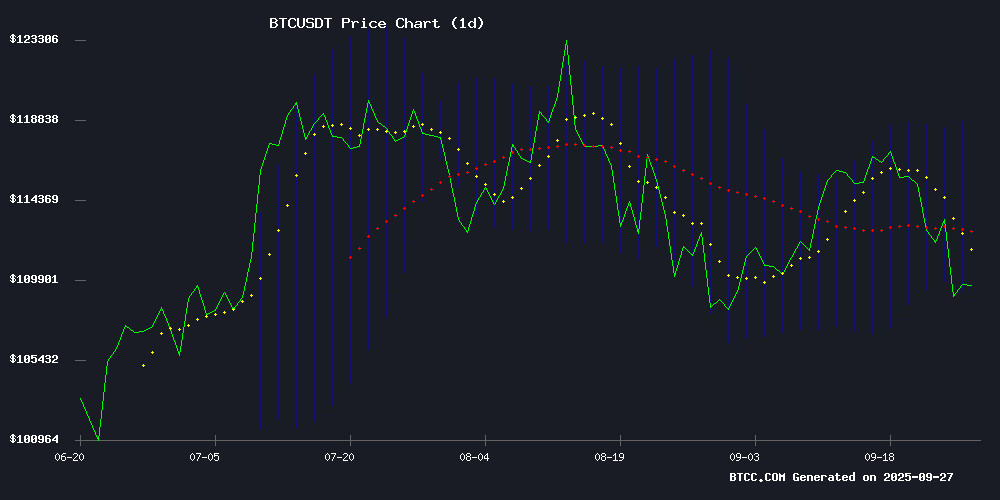

BTC is currently trading at $109,347, below its 20-day moving average of $113,921, indicating potential short-term bearish pressure. The MACD shows a positive histogram of 1723.91, suggesting some bullish momentum despite the negative signal line. Bollinger Bands position the price NEAR the lower band at $108,915, which could act as immediate support., notes: 'The $109K level represents a critical technical juncture. A sustained break below could target $105K, while holding above may trigger a rebound toward the middle Bollinger Band around $113,921.'

Market Sentiment: Volatility Dominates Amid Options Expiry and Regulatory Concerns

Recent headlines highlight increased volatility with $17B options expiry and ransomware attacks demanding Bitcoin payments. Positive notes include Bitcoin holding steady near $109K post-PCE data and cyclical comparisons to 2017's bull run., comments: 'News flow is mixed but aligns with technical support levels. The $200K prediction echoes 2017 patterns, though trader caution persists short-term. Regulatory and security events may amplify swings, but institutional partnerships like EMCD-STABUL reinforce long-term credibility.'

Factors Influencing BTC’s Price

Exclusive Interview: The Crypto Factor Behind Modern Ransomware

Cryptocurrency has become the lifeblood of the global ransomware industry, with 97.8% of tracked ransomware payments made in digital assets last year, according to Chainalysis. Bitcoin's pseudonymous, borderless nature has supercharged cybercrime, enabling attackers to demand payments across jurisdictions without revealing identities.

The automation of decryption keys upon payment receipt has streamlined cash conversion for ransomware crews. Funds are frequently chain-hopped from Bitcoin to stablecoins and across multiple blockchains to obscure trails. This evolution has transformed ransomware from isolated incidents into a industrialized criminal enterprise.

Hospitals, governments, and educational institutions remain prime targets, with nearly all demands denominated in cryptocurrency. The 2025 crypto breach landscape shows stolen funds surpassing previous annual totals, marking a disturbing acceleration in crypto-enabled cybercrime.

BTC Volatility Rises Ahead of $17B Options Expiry and Market Moves

Bitcoin faces heightened volatility as macroeconomic pressures and options market dynamics create uncertainty. Despite recent corrections, the cryptocurrency remains a focal point for investors awaiting favorable conditions to deploy capital.

Traditional markets are absorbing risk appetite, with the Dow Jones, NASDAQ, and S&P 500 hitting record highs. Meanwhile, the 10-year Treasury yield dipped to 4.01%, reflecting a flight to safety that has temporarily dampened BTC's momentum.

Stablecoin reserves have ballooned from $204 billion to $308 billion since January 2025, signaling $100 billion in dry powder ready to flow into Bitcoin when sentiment shifts. This liquidity overhang suggests latent buying pressure could materialize rapidly.

Maryland Transportation Department Hit by Ransomware Attack Demanding $3.4M in Bitcoin

The Maryland Department of Transportation faces a severe cybersecurity breach after the Rhysida ransomware group infiltrated its systems. Attackers are auctioning stolen data—including Social Security numbers and personal addresses—for 30 BTC (~$3.4M) on the dark web, with a seven-day deadline for bids.

Critical divisions like aviation, highways, and transit operations may be compromised, though services remain operational. Maryland officials, working with cybersecurity firms, have withheld details citing an active investigation.

Bitcoin Holds Steady Near $109K as PCE Data Meets Expectations

Bitcoin's price stabilized around $109,000 following the release of US inflation figures that aligned perfectly with market forecasts. The Core PCE index rose 2.9% annually while headline PCE climbed 2.7%, offering no surprises to traders.

Elon Musk's Grok AI maintained its prediction that September would close near current levels. Market participants noted the readings, though above the Fed's target, leave room for potential rate cuts as early as October.

Order book data revealed concentrated bid support at $108,200 on Binance, with liquidation levels hovering just above $110,000. Glassnode reported another wave of long liquidations during the session's dip below $111,000, characterizing the move as part of an ongoing market deleveraging cycle.

Bitcoin’s 2025 Cycle Mirrors 2017 as Analysts Eye $200K Threshold

Bitcoin's price action in the third quarter of 2025 shows striking parallels to its 2017 cycle, with a consolidation range between $100,000 and $115,000 forming a technical base at $107,000. Historical cycle correlations exceed 90%, suggesting a potential rally into Q4 if key support levels hold.

The 2025 market landscape diverges significantly from 2017 due to institutional inflows via spot ETFs, corporate treasury adoption, and regulatory evolution. Exchange flow volume and ETF net flows now drive cycle inflection points, replacing the retail-dominated order books of previous cycles.

Technical indicators present a neutral to bullish outlook, with weekly MACD and daily RSI trends reflecting similar patterns to previous market troughs. The $200,000 price projection remains contingent on maintaining current support levels and attracting fresh capital inflows.

Athena Bitcoin Faces Lawsuit Over Alleged Source Code Theft

Athena Bitcoin, a major U.S. Bitcoin ATM operator, is embroiled in a legal battle after AML Software accused it of attempting to steal copyrighted source code. The Illinois-based lawsuit alleges copyright infringement and trade secret misappropriation, centering on Athena's efforts to gain control over 3,000 cryptocurrency ATMs.

AML Software claims Athena knowingly sought unauthorized access to proprietary software that powers bitcoin ATMs. Jordan Mirch, CEO of Taproot Acquisition Enterprises, is named as a key defendant for allegedly orchestrating the unlawful transfer of code during ATM operator transitions.

Bitcoin Tests Critical Support at $109K Amid Market Volatility

Bitcoin's price action hinges on the $109,000 support level after a 5.28% weekly decline, with $1.65 billion in long positions liquidated. Market stability persists as the ELR ratio holds at 0.285, but traders eye a decisive break above $112,000 or risk a slide toward $107,000.

CryptoRobotics notes indecision in BTC's price structure following a false breakout at $113,800. Analysts suggest the $109K level could catalyze either a rebound to $115K or accelerate losses if breached. 'The market is balancing on a knife's edge,' remarked one trader, with derivatives data revealing heightened speculative activity.

EMCD Partners with STABUL to Bridge Traditional Finance and Crypto Markets

EMCD, one of the world's top seven Bitcoin mining pools, is expanding its financial ecosystem by integrating STABUL Finance. The move will provide EMCD's 400,000+ users access to stablecoins and tokenized real-world assets, further blurring the lines between traditional finance and cryptocurrency markets.

The platform, which began as a Bitcoin mining pool in 2017, has evolved into a comprehensive crypto-financial service operating in over 80 countries. Its recent 'Crypto Mining Pool of the Year' award at the FinanceFeeds Awards 2025 underscores its transformation into a full-fledged financial platform.

With a hashrate of 23.67 EH/s, EMCD contributes 1.9% of Bitcoin's global hashrate and dominates Eastern Europe's mining landscape. The platform's 'closed capital loop' approach allows users to mine, earn yield, trade peer-to-peer, and soon spend via crypto debit cards—all within a single ecosystem.

EMCD's Coinhold feature offers up to 14% APY on crypto holdings, significantly outpacing traditional bank savings rates. This yield is generated through conservative liquidity provisioning for internal exchanges rather than high-risk DeFi protocols.

Bitcoin Traders Lose Confidence as Odds Favor Dip to $105K Over $125K Milestone

Bitcoin's recent price weakness has shifted market sentiment, with predictors on Myriad now favoring a drop to $105,000 before a rally to $125,000. Odds for the lower target surged to 68% this week, marking a 25% increase—with over half that movement occurring in just 48 hours. The asset hovers 4% above $105,000 as of press time.

The downward pressure coincides with a 5% weekly decline, pushing BTC below $110,000 for the first time since early September. Flat trading followed August's U.S. core inflation data holding at 2.9%, while geopolitical risks from new tariff announcements further dampened risk appetite. "Capital flows remain cautious," noted Bitunix analyst Dean Chen.

Bitcoin's Sharp Decline: Four Key Drivers Behind the Selloff

Bitcoin's price plunged below $110,000 this week, marking a six-week low and unsettling even veteran traders. The selloff reflects a confluence of market forces, from derivatives expiration to macroeconomic tremors.

Deribit's $22 billion options expiry amplified volatility as traders scrambled to adjust positions. The event coincided with Bitcoin testing critical support levels, triggering cascading liquidations across leveraged positions.

Political uncertainty in the US and unexpected economic data further eroded risk appetite. The crypto market's sensitivity to these traditional finance indicators underscores its growing integration with broader capital markets.

MicroStrategy Faces ‘Brutal Bear Market’ as MSTR Stock Plummets Amid Bitcoin Downturn

MicroStrategy’s MSTR stock has plunged 45% from its November 2024 peak, as the company grapples with a vicious feedback loop of declining Bitcoin prices and eroding market confidence. The firm, which holds over 1 million BTC collectively with other public companies, now faces existential questions as crypto markets bleed.

Michael Saylor’s bold 2020 Bitcoin bet initially paid off spectacularly, with MSTR soaring from $132 to $543 on hype around corporate crypto adoption. But the tide has turned sharply by September 2025, with analysts warning of potential distressed selling if the bear market deepens.

The Bitcoin Treasury sector—where MicroStrategy remains the undisputed leader—has become ground zero for the current crypto rout. Even staunch supporters now question whether the company’s high-wire act can survive sustained pressure.

Is BTC a good investment?

Based on current data, BTC presents a nuanced opportunity. Technically, it's testing key support at $109K, with Bollinger Bands suggesting a potential rebound if held. Fundamentally, cyclical comparisons to 2017's rally toward $200K exist, but short-term headwinds like options expiry and security concerns inject volatility.

| Metric | Value | Implication |

|---|---|---|

| Price vs. 20-Day MA | $109,347 (Below MA) | Short-term bearish pressure |

| MACD Histogram | +1723.91 | Bullish momentum building |

| Bollinger Band Position | Near Lower Band ($108,915) | Oversold conditions may support bounce |

Emma emphasizes: 'Dips to $105K could offer entry points for long-term investors, but risk management is vital given recent volatility.'